What's a Good Interest Rate for a Car Loan?

Interest rates vary based on a person’s credit score, the length or term of the loan, and other factors we’ll discuss further in this article.

Keep in mind that interest rates fluctuate and where you get your car loan will affect the interest rate offered to you. For example, franchise car dealers and credit unions, which are non-profit organizations, may offer lower interest rates than banks. So while there is no typical car loan interest rate, as you start to research rates you’ll find a range of rates unique to your situation.

Credit Union of Southern California (CU SoCal) is Southern California's fastest growing credit union offering up to 120% financing for new and used vehicles1, low rates, quick pre-approvals, no application or funding fees, a personal auto-buying concierge service, and more!

Call CU SoCal at 866-287-6225 to schedule a no-obligation loan consultation, or apply online today!

Get Started on Your Auto Loan!

How Interest Rates are Determined

Your car loan interest rate will be determined by the factors listed below:

Credit Score: Borrowers with high credit scores in the “exceptional” (800-850) and “very good” (740-749) range will be offered lower rates, while those with lower credit scores in the “fair” (580-669) to “poor” (300-579) range will be offered higher interest rates.

Buying New vs. Used: New car loan rates are generally lower than used car rates for several reasons, including auto manufacturers providing incentives for car buyers to purchase new vehicles. Used car loans have higher interest rate because it's a smaller loan and the fact that the person is buying a used car makes the transaction seem much riskier to the dealer. The lender may adjust the interest rate in fear that the value of the car will dip below the value of the loan. In a case like that, if the borrower defaults on the loan, the dealer can have a hard time recouping the money.

1

Loan Term (length of time you’ll have the loan): The longer your repayment term, the more risk it carries for the lender—both that you might default on your payments and that market interest rates may increase, making your loan less profitable than new loans.

2 If you choose a longer term loan, your monthly payments will be less because the price you paid for the car is spread out over time. However, you’ll pay more interest overall as a result.

Down Payment: Putting more money down on your purchase reduces how much you owe and decreases the risk associated with your loan. As a result, making a sizeable down payment on the purchase could result in a lower interest rate.

What Is the Average Rate on a Car Loan?

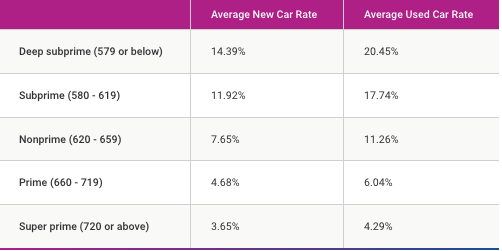

To help you better understand how credit scores correspond to car loan interest rates for new and used (pre-owned) vehicles, here are some average interest rates on car loans, based on credit score tier:

Where to Find Low APR Car Loans

Most people are surprised to learn that the interest rate and APR on a car loan are two different entities. The interest rate on a car loan does

not include fees charged for the loan. The Annual Percentage Rate (APR) is the total cost the borrower pays on the loan each year,

including fees, which are expressed as a percentage.

So when shopping for a car loan, the number you want to look for is a low APR. A good APR for a car loan is one that is low compared to other rates you’ve been quoted, and one that works for your budget.

Credit unions: The average interest rate on a car loan from a credit union is typically lower than rates offered by traditional banks. Credit Unions are non-profit organizations that reinvest their earnings into member discounts and other perks. The advantages of getting a car loan from a credit union, such as CU SoCal, includes personal auto-buying concierge service, low-cost loan protection add-ons, no application or funding fees, and lending options for buyers with bad credit.

Dealerships: Car manufacturers offer interest rate incentives to car dealers which helps the dealer compete for your business. To get a good APR for a car loan, be sure to ask the dealer about special financing promotions. The main difference between credit union and dealership financing is customer service. Down the road, if you have questions about your loan, you’ll need to correspond directly with the financing company that holds the loan.

Banks: Similar to credit unions, your local bank branch in which you have an account will be happy to help you with your loan. Also like credit unions, banks can provide a pre-qualification. However, if you have bad credit or no credit, it could be more difficult to get approved for a loan, as lending guidelines are often stricter.

Tip: You Can Negotiate APR on a Car Loan!

Just like the sales price of the vehicle, APR is negotiable. According to

Consumerfinance.gov, the loan rate the dealer first offers you may not be the lowest rate you qualify for, so ask the salesperson for the lowest APR. Be sure to compare the dealer’s interest rate to the competitive rates offered by CU SoCal.

So what is a good interest rate on a car loan? After doing your research and talking to the lending professionals at your credit union, dealership or bank, the best rate is the one that you can afford to pay monthly over the life of the loan. Driving your new (or pre-owned) car should feel good, and so should the loan that you choose!

Why Savvy Consumers Choose CU SoCal

At CU SoCal, we lend on character, not just on credit scores. If you’ve been turned down for an auto loan because of a low credit score, we can help! We listen to your story and look beyond your credit score today to offer the right auto loan that will help you become financially stronger tomorrow.

Credit Union of Southern California proudly serves Orange County, San Bernardino County, and Riverside County. We are the fastest growing credit union in Southern California!

Please give us a call today at 866.287.6225 for an expert, no-obligation consultation or apply for a CU SoCal auto loan today!

SOURCES

1 Source: Carsdirect.com https://www.carsdirect.com/auto-loans/how-car-loan-interest-is-determined

2 Source: Experian™ https://www.experian.com/blogs/ask-experian/auto-loan-rates-by-credit-score/

Get Started on Your Auto Loan!