Why is credit score important?

A good credit score can help you obtain the best interest rates on new credit accounts, auto loans, mortgages, personal loans, and other types of loans. Access to low interest rate loans means having more money available to improve your financial position. This is one of the main benefits of having good credit.

At Credit Union of Southern California (CU SoCal), we make checking your credit score easier.

Call 866.287.6225 today to schedule a no-obligation consultation and learn about our home equity lines of credit, auto loans, personal loans, checking and savings accounts, and other banking products. As a full-service financial institution, we look forward to helping you with all of your banking needs.

Why is credit score important? Read-on to learn more.

Get Started on Your Credit Builder Today

How are credit scores calculated?

The most widely use credit scores are FICO scores, which were developed by Fair Isaac Company, Inc.

FICO uses five categories to calculate credit scores. The percentages in the parentheses, below, reflect how important each of the categories is in determining how your FICO Scores is calculated.

Everyone’s credit profile is unique. Therefore, the importance of these categories will be different for everyone. For example, the credit scores of people who have not been using credit very long (such as young adults) will be calculated differently than those with a longer credit history.

As the information in your credit report changes, so does the evaluation of these factors in determining your FICO Scores.

Payment history (35%). This is the most important factor in a FICO Score. Payment history keeps track of whether you have been able to meet all your payments on time when payments are due. This can take into consideration your payments on credit cards, mortgage, car loan, student loans, medical bills, and other personal debt. The more consistently you complete your payments, the higher your score will be.

Amounts owed (30%). Having credit accounts and owing money on them doesn’t necessarily mean you are a high-risk borrower with a low FICO Score. However, if you are using a lot of your available credit, this may indicate that you are overextended—and banks can interpret this to mean that you are at a higher risk of defaulting. Amounts owed can also be referred to as “debt burden.”

Length of credit history (15%). Your credit history and age of your accounts contributes to 15% of your credit score. The longer you have had your credit accounts, like a credit card, the better a potential lender is to see how you manage debt. If you've successfully paid your credit card bill each month for several years, lenders will see you are a reliable borrower.

Credit mix (10%). FICO Scores will consider your mix of credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. Don't worry, it's not necessary to have one of each.

New credit (10%). Research shows that new credit applications and opening several credit accounts in a short amount of time represents a greater risk, especially for people who don't have a long credit history.

Bankruptcies. According to myfico.com, a bankruptcy will always be considered a very negative event by your FICO Score. How much of an impact it will have on your score will depend on your entire credit profile. There are a few types of bankruptcies and how long they stay on your credit report is different. All the individual accounts included in the bankruptcy should be removed from your credit report after seven years.

What is a good credit score?

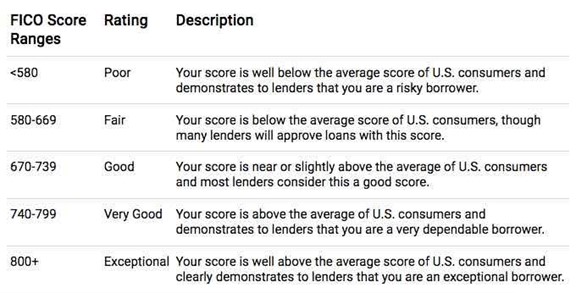

A FICO score will fall between 350 (high risk) and 850 (low risk). The best credit advantages are associated with having “very good” or “exceptional credit.” Individuals with “good” credit are also able to receive better interest rates on loans.

(source: https://www.myfico.com/credit-education/credit-scores)

Individuals with “fair” or “poor” credit may be at risk of getting turned down for loans and credit or may pay higher interest rates. Need help with your credit score? Here are

eight tips for building credit.

Benefits of having a good credit score

What are the benefits of having a good credit score? As we mentioned earlier, having a good credit score opens the door to getting low interest rates on loans, including auto loans and mortgages. Having access to cash means more financial opportunities. Some employers will even look at a person’s credit score in order to assess their financial responsibility as it relates to a particular job.

Here are some of the benefits of having good credit:

Better rates on auto loans. A higher score means less risk of defaulting on a loan, and you’ll be offered a lower interest rate on auto loans.

Higher credit limits. With a good score creditors are more likely to provide a higher credit limit on credit cards.

Lower credit card interest rates. Similarly, people with good credit are given a lower APR (annual percentage rate) on credit card balances.

Save on insurance. Some insurance providers will offer a better, lower premium to customers with good credit.

More housing options. If you are seeking to rent, landlords are eager to rent to people with good credit scores, as it shows financial responsibility and means less risk of non-payment.

Security deposit waivers on utilities. Some utility companies look at a person’s credit score and will require a deposit if a score is considered too low.

More job opportunities. These days it’s become increasingly common for employers to do a credit check and use that as one of the hiring criteria.

How often do credit scores update?

Because credit is fluid, there is no fixed timeframe that credit scores update. However, in general, credit scores update every 30-45 days.

Learn more about how often credit scores update.

How to improve your credit score

The importance of a credit score cannot be understated. In today’s world, credit is everything.

For example, while it is possible to

get a car with bad credit, you’ll likely pay a high interest rate on a loan. It is also possible to

get a personal loan with bad credit, but be prepared to pay higher interest on this type of loan as well.

If you find that bad credit is preventing you from experiencing the benefits of having good credit or getting approved for credit cards, loans, or jobs, you’ll want to take steps to start rebuilding credit and raising credit scores.

Follow these tips ensure your credit score stays in the “very good” or “exceptional” range:

1. Pay your bills on time

2. Pay off debt and keep credit card balances low

3. Open new credit accounts only as needed

4. Don't close unused credit cards

5. Dispute inaccuracies on your credit reports

6. Increase your credit limits

7. Use credit monitoring to check your progress

Learn more about

how to rebuild and improve your credit score.

How to check your credit score for free

There are several ways to get your credit score for free and other methods that come with a fee.

When it comes to the best ways to check credit score in general, the Consumer Financial Protection Bureau suggests these options:

Credit-scoring websites. There are online providers of credit scores, including

annualcreditreport.com.

Credit card providers. Many card providers, including Credit Union of Southern California, provide your credit score on your monthly credit card statement. If you have paperless billing check your credit card’s online dashboard for your score.

Credit counselor. If you have bad credit you may seek the assistance of a non-profit credit counselor to provide you with strategies to help you

rebuild credit. Non-profits offer free services and will provide you with your score as part of the process.

Buy your score. You can buy a score directly from a credit reporting company. You also can buy your FICO score directly from

myfico.com.

Learn more about how to check your credit score.

Tracking your credit score at CU SoCal

At Credit Union of Southern California we believe you should have instant and free access to one of the most important numbers in your financial life — your credit score.

With

Credit Score and More, you can check your real time credit score and view your credit history instantly, through

Online and

Mobile Banking. There is no cost or credit card needed. This service is 100% free to all CU SoCal Members. We are happy to help our Members take advantage of the benefits of having good credit.

Why Savvy Consumers Choose CU SoCal

For over 60 years CU SoCal has been providing financial services, including car loans, mortgages, Home Equity Loans, HELOCs, personal loans, credit cards, and other banking products, to those who live, work, worship, or attend school in Orange County, Los Angeles County, Riverside County, and San Bernardino County.

Please give us a call today at 866.287.6225 today to schedule a no-obligation loan consultation with a CU SoCal Member Services specialist.

Get Started on Your Credit Builder Today