Do VA loans have PMI?

Veterans Administration (VA) Loans were created to help active-duty service members, veterans, National Guard, Reserve service members, other uniformed service personnel, and eligible spouses become homeowners.

Unlike conventional mortgage loans, VA loans do not have PMI. However, VA loans do have a funding fee, which is paid at closing.

At Credit Union of Southern California (CU SoCal), we make buying a home in California easy.

Call 866.287.6225 today to schedule a no-obligation consultation and learn about our auto loans, home equity lines of credit, personal loans, checking and savings accounts, and other banking products. As a full-service financial institution, we look forward to helping you with all of your banking needs.

Do VA loans have mortgage insurance? Read on to learn more.

Get Started on Your Mortage Today!

What is the VA home loan funding fee?

The VA funding fee is a one-time payment that the veteran, service member, or survivor pays on a VA-backed or VA direct home loan. This fee helps to lower the cost of the loan for U.S. taxpayers since the VA home loan program doesn’t require down payments or monthly mortgage insurance.

VA funding fee vs. PMI: what's the difference?

Do you have to pay PMI on a VA loan? As we mentioned above, the VA funding fee helps to lower the cost of the loan for U.S. taxpayers since the VA home loan program doesn’t require down payments or monthly mortgage insurance.

PMI is a type of insurance that protects the lender if the borrower is not able to pay their mortgage. It’s usually required on conventional loans when the buyer/borrower makes a down payment of less than 20% of the total mortgage amount.

How much is the VA funding fee?

The amount you pay will depend on the amount of your loan and other factors.

For all loans, the VA will base your VA funding fee on:

- The type of loan you get.

- The total amount of your loan. (The VA will calculate your funding fee as a percentage of your total loan amount.)

Depending on your loan type, the VA may also base your fee on:

- Whether it’s your first time, or a subsequent time, using a VA-backed or VA direct home loan.

- Your down payment amount.

Your home loan lender will determine these details of your loan:

- Interest rate

- Discount points (fees you may pay to your lender at closing to get a lower interest rate on your loan)

- Other closing costs

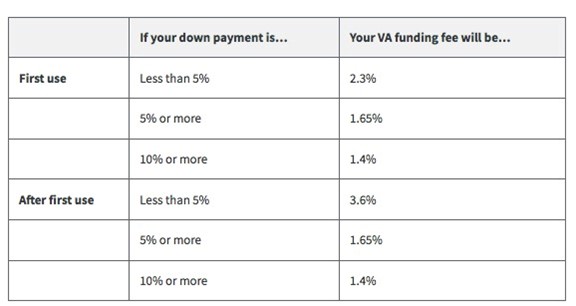

Veterans, active-duty service members, and National Guard and reserve members seeking a VA-backed purchase or construction loan, can use this VA funding fee rate chart to determine the amount you’ll have to pay. Down payment and VA funding fee amounts are expressed as a percentage of the total loan amount.

(

Source: https://www.va.gov/housing-assistance/home-loans/funding-fee-and-closing-costs/)

When is the VA funding fee paid?

You’ll pay this fee when you close your VA-backed or VA direct home loan.

You can pay the VA funding fee in either of these ways:

- Include the funding fee in your loan and pay it off over time (called financing), or

- Pay the full fee all at once at closing

VA funding fee exemptions

You won’t have to pay a VA funding fee if any of the below descriptions is true.

- Receiving VA compensation for a service-connected disability.

- Eligible to receive VA compensation for a service-connected disability, but you’re receiving retirement or active-duty pay instead.

- The surviving spouse of a Veteran who died in service or from a service-connected disability, or who was totally disabled, and you're receiving Dependency and Indemnity Compensation (DIC).

- A service member with a proposed or memorandum rating, before the loan closing date, saying you're eligible to get compensation because of a pre-discharge claim.

- A service member on active duty who before or on the loan closing date provides evidence of having received the Purple Heart.

VA funding fee refund

You may be eligible for a refund of the VA funding fee if you're later awarded VA compensation for a service-connected disability. The effective date of your VA compensation must be retroactive to before the date of your loan closing.

If you think you're eligible for a refund, please call your VA regional loan center at

877-827-3702, Monday through Friday, 8:00 a.m. to 6:00 p.m. ET.

When is PMI Required?

VA loans never require private mortgage insurance (PMI).

Pros and Cons of VA loansPros

For eligible Veterans of U.S. Military service, and qualifying surviving spouses, there are several advantages to VA Loans.

- No down payment. A down payment on the home purchase is not required.

- No private mortgage insurance (PMI). PMI is required on conventional loans when the buyer makes less than 20% down payment.

- Low interest rate. VA loan interest rates are typically lower than conventional rates

- Flexible credit score. Most lenders allow lower credit score thresholds on VA loans.

Cons

As with any mortgage loan, there are advantages and disadvantages to be aware of. Understanding these will help you determine which loan best meets your needs.

- Only for primary homes. To be eligible, you must live in the home for which you are seeking financing.

- Not all properties are eligible. A VA loan cannot be used to purchase land or investment properties

- VA loan funding fee. If you’re using a VA home loan to buy, build, improve, or repair a home or to refinance a mortgage, you’ll need to pay the VA funding fee unless you meet certain requirements (stated above).

Why Savvy consumers choose CU SoCal

For over 60 years CU SoCal has been providing financial services, including car loans, mortgages, Home Equity Loans, HELOCs, personal loans, credit cards, and other banking products, to those who live, work, worship, or attend school in Orange County, Los Angeles County, Riverside County, and San Bernardino County.

Please give us a call today at 866.287.6225 today to schedule a no-obligation loan consultation with a CU SoCal Member Services specialist.

Get Started on Your Mortgage Today!

Get Started on Your Mortage Today!