Roth IRA income and contribution limits

Opening a Roth IRA account can be a great way to earn income for your retirement. However, there are Roth IRA income limits and Roth IRA contribution limits to be aware of. This includes an annual Roth IRA limit.

Federal tax law places limits on the dollar amount of contributions to ally types of retirement plans, including Individual Retirement Arrangements, also known as Individual Retirement Accounts, or simply, IRAs.

The most you can contribute to all your traditional and Roth IRAs is the smaller of these dollar amounts:

- For 2022: $6,000, or $7,000 if you’re age 50 or older by the end of the year; or your taxable compensation for the year.

- For 2023: $6,500, or $7,500 if you’re age 50 or older by the end of the year; or your taxable compensation for the year.

Contributions for 2022 can be made up until April 18, 2023.

If you’re ready to start saving money with a Roth IRA account, we can help! At Credit Union of Southern California (CU SoCal), we make getting a Roth IRA account easier.

Call 866.287.6225 today to schedule a no-obligation consultation and learn about our home equity lines of credit, auto loans, personal loans, checking and savings accounts, and other banking products. As a full-service financial institution, we look forward to helping you with all your banking needs.

Read-on to learn more about Roth IRA contribution limits

Get Started on Your IRA Today!

What is a Roth IRA?

A Roth IRA is a special type of retirement account that allows your monetary contributions and interest earnings to grow tax-free.

You can contribute to a Roth IRA at any age if you, or your spouse if file your income taxes jointly, have taxable income. Taxable income is any income (including wages, salary, commission, and alimony), and your modified adjusted gross income is below a certain amount specified by the IRS.

Roth IRAs are funded with your after-tax dollars, and you can make tax-free and penalty-free withdrawals after age 59 and one-half.

Learn more about what is a Roth IRA.

Amount of Roth IRA Contributions You Can Make for 2023

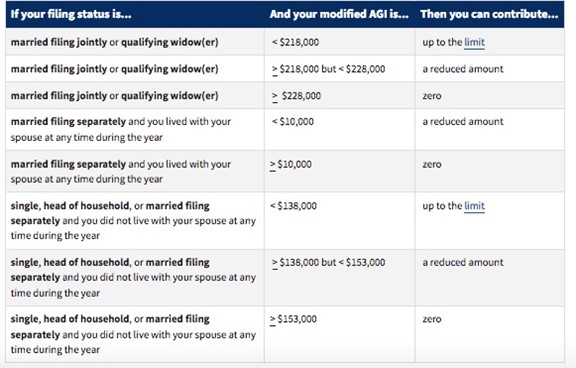

This table shows whether your contribution to a Roth IRA is affected by the amount of your Modified Adjusted Gross Income (your adjusted gross income, plus exempt deductions you may take). An income tax professional can help you make these calculations.

Other Roth IRA rules to know

Roth IRAs have unique conditions and requirements to be aware of. These include:

Contribution limits based on taxable income. As the table above shows, taxable income is one of the two main factors that determines someone’s contribution limit.

Eligibility requirements. To open an account, you will need to provide proof of identity and your social security number. There is no age requirement for opening a Roth IRA account.

Contribution deadlines. You can make 2022 IRA contributions until April 18, 2023.

Withdrawals. You will not pay a penalty if you withdraw any part of the amount you have contributed and leave the earnings potion in the account. Withdrawing earnings before the allowable timeframe (five years) will result in a penalty unless you meet the exception criteria specified by the IRS.

5-year rule. For Roth earnings to be tax-free, the account holder must have the account for more than five years or before or before the age 59 and one-half. If you do withdraw earnings before this age, you will be required to pay income taxes and a 10% early withdrawal penalty on the earnings you withdraw.

Taxes. One of the advantages of the Roth IRA is that earnings grow tax-free, and qualified withdrawals are tax- and penalty-free.

Roth IRA FAQs

What if my income is too high?

If your income is too high for a Roth IRA account due to the income limits, then consider opening a Traditional IRA which has no income limit.

What if I contribute too much?

It’s important to keep track of how much you contribute to your Roth IRA. If you contribute more than the contribution limit, be aware that excess contributions are taxed at 6% per year for each year the excess amounts remain in the IRA. The tax can't be more than 6% of the combined value of all your IRAs as of the end of the tax year.

To avoid the 6% tax on excess contributions, you must withdraw the excess contributions from your IRA 1) by the due date of your individual income tax return (including extensions) and 2) any income earned on the excess contribution.

What are catch-up contributions?

For people who haven’t been regularly contributing to a retirement account, catch-up contributions provide the opportunity to literally catch up on making investment contributions. Individuals who are age 50 or over at the end of the calendar year can make annual catch-up contributions. You can make catch-up contributions to your traditional or Roth IRA up to $1,000 for 2022 and 2023. Catch-up contributions to an IRA are due by the due date of your tax return (not including extensions).

Are there age limits to making contributions?

No. For 2020 and later, there is no age limit on making regular contributions to a Roth IRA.

Roth IRA vs. Traditional IRA vs. 401k: what's the difference?

As we’ve discussed in this article, a Roth IRA has certain age and income requirements, and the earnings are taxed differently than those of a traditional IRA. Unlike a Roth IRA, traditional IRAs have no income limits to open an account. Because traditional IRAs are tax-exempt at the time they are deposited, you will pay tax in retirement when distributions (withdrawals) are made. 401(k) accounts are employer-sponsored, meaning that employees make contributions into specific plans offered by their employer through a brokerage company that has partnered with the employer. All three types of retirement accounts (e.g., Roth and traditional IRAs, 401ks, etc.) have detailed and specific nuances that you should be aware of before you invest. Be sure to consult with your tax preparer or other trusted financial professional before you invest.

Can I contribute to a Roth IRA and a Traditional IRA?

Yes. Plus, you can contribute to a traditional or Roth IRA even if you participate in another retirement plan through your employer or business. However, you may not be able to deduct all your traditional IRA contributions if you or your spouse participates in another retirement plan at work.

How can I open a Roth IRA?

You can open a Roth IRA at a credit union, bank, brokerage or and other financial institutions. Opening a Roth IRA is a simple process like opening any other financial account. You will complete an application that includes your name, address and social security number. You will also need to provide a government-issued proof of identification.

Why savvy consumers choose CU SoCal

For over 60 years CU SoCal has been providing financial services, including mortgages, Home Equity Loans, HELOCs, car loans, personal loans, credit cards, and other banking products, to those who live, work, worship, or attend school in Orange County, Los Angeles County, Riverside County, and San Bernardino County.

Please give us a call today at 866.287.6225 today to schedule a no-obligation loan consultation with a CU SoCal Member Services specialist.

Get Started on Your IRA Today!