How To Rebuild & Improve Your Credit Score

While having a bad credit score is not ideal, it's also not the end of the world. No matter how bad your credit score is, rebuilding credit is entirely achievable, with determination and the right plan.

Credit Union of Southern California (CU SoCal) has been providing financial services, including personal loans to pay off credit card debt, to those who live, work, worship, or attend school in Orange County, Los Angeles County, Riverside County, and San Bernardino County for over 60 years, and is the fastest growing credit union in Southern California.

Our core values, Member satisfaction, commitment to low rates and fees, and friendly service make doing business with us easy and stress-free.

Get Started on Your Credit Card Today

Why Credit Is Important

Credit is a central part of any loan application process, whether you are applying for a credit card, auto loan, a new mortgage or a mortgage refinance. Some employers will even look at your credit score during the hiring process to gauge a potential employee’s trustworthiness and ability to manage finances.

A credit history and credit score are the primary factors lenders will look at and use to determine a borrower’s ability to repay a loan.

Having good credit means you’ll benefit from better interest rates, more buying power, and better loan terms. Those are the “rewards” for being a low-risk to lenders.

Because credit is an integral part of doing business in the world, it’s important to make on-time payments on your loans and credit cards. When you make late payments or make no payment at all, you’ll likely be charged fees and may have your credit frozen or reduced. Homeowners who miss or skip mortgage payments could end up in foreclosure. Late or missed payments are reported to the nation’s credit bureaus by lenders, with each negative report having a negative impact on your credit score.

Once your credit is damaged this way, you will need to rebuild credit and restore credit in order to continue to get new credit.

How Credit Scores are Calculated

Credit scoring is a system creditors use to help determine whether to give you credit.

Your credit history — including information about your credit experiences, such as your bill-paying history, the number and type of accounts you have, late payments, collection actions, outstanding debt, and the age of your accounts — is collected from your credit applications and your credit report.

A credit scoring system awards points for each factor. A credit score generally indicates how creditworthy you are, that is, how likely it is you will repay a loan and make on-time payments. Lenders look at credit scores to determine who is most likely to repay a debt.

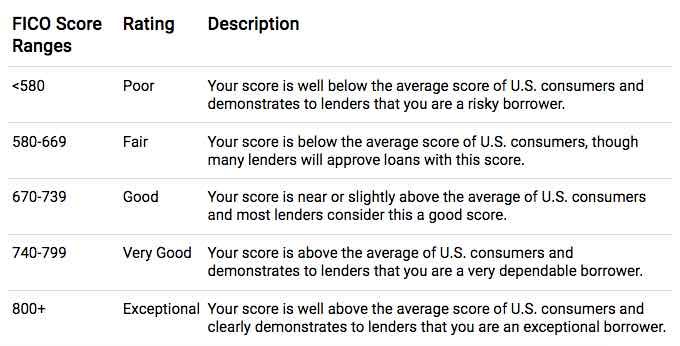

The most widely use credit scores are FICO scores, which were developed by Fair Isaac Company, Inc. A FICO score will fall between 350 (high risk) and 850 (low risk).

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%).

7 Ways To Improve Your Credit Score

If you find that bad credit is preventing you from getting approved for credit cards, loans, or jobs, you’ll want to take steps to start rebuilding credit and raising credit scores.

We are often asked, “What is the quickest way to raise my credit score?” and “What is the fastest way to rebuild credit?” While there is no one fast way to raise your credit score, these strategies can help you incrementally raise credit scores in a few months.

Here are the 7 Ways to Improve Your Credit Score

1. Pay Your Bills On Time

Paying bills on time is critically important. This one factor can make or break your credit score. A creditor can report your late payment to the credit bureaus (Experian, Equifax and TransUnion) once you're 30 days late, and the late payment can remain on your credit reports for up to seven years.

2. Pay Off Debt and Keep Credit Card Balances Low

Paying off your credit card balances is beneficial to credit scores because it lowers your

credit utilization ratio.

Utilization, which is the amount of available credit you're using, makes up 30% of a FICO score, and is the second most important factor in credit scores, right behind payment history (which accounts for about 35% of a credit score).

Credit utilization is calculated by dividing a credit card's balance by the credit limit.

Generally, a good credit utilization ratio is less than 30 percent, which means you're using less than 30 percent of the total credit available to you. On a credit card with a $1,000 limit, that means keeping your balance below $300.

1

Paying bills in full each month is the ideal way to avoid paying high interest payments and accumulating debt that could get out of control. If you must carry a balance keep it as low as you can. Carrying a balance will not improve your credit score.

3. Open New Credit Accounts Only as Needed

According to the Credit Reporting Agency Experian, a hard inquiry will stay on your credit report for two years. While lenders can see all inquiries made during that time, the inquiries only directly affect your credit score for one year at most.

When you apply for a credit card you may initially see a small drop in your credit score. Over time, that impact will diminish, and with responsible credit behavior, you'll recover from the drop fairly quickly.

To keep your score strong, apply only for the credit you truly need. If you plan to apply for a major new credit product, like a mortgage, in the next several months, experts say you should avoid applications for other new credit to keep your score as high as possible.

The number of credit accounts you've recently opened, as well as the number of

hard inquiries lenders make when you apply for credit, accounts for 10% of your FICO

® Score.

4. Don't Close Unused Credit Cards

Myfico.com recommends never closing a credit card for the sole purpose of raising your FICO Score.

The decision to close down credit cards depends on your reasons for taking this action. If you are tempted to charge more than you should just because you have more availability to credit, then getting rid of that temptation by closing some credit cards might be your best course of action.

Closing an old or unused card means you are essentially wiping away some of your available credit which would increase your credit utilization ratio, and negatively affect your credit score.

5. Dispute Inaccuracies on Your Credit Reports

Checking your credit will help you see what factors are bringing your score down, giving you another avenue to restore credit. It’s also important to review your report for errors, which you can dispute and get corrected, if the error is found to be legitimate.

Under federal law, you are entitled to a free copy of your credit report once every 12 months from each Credit Reporting Agency (also called a Credit Bureau).

To request your credit report visit

www.AnnualCreditReport.com. During these times of COVID-19, Equifax®, Experian™, and TransUnion® are offering free weekly online reports through April 2021.

Or, you may contact each of the three major credit bureaus:

Equifax: 800-685-1111 (option 3)

Experian: 888-397-3742

TransUnion: 800-916-8800 (option1)

If you find an error on your credit report, you have a right to dispute the inaccuracy. There is no cost or fee to dispute mistakes or outdated items on your credit report.

You don’t need to hire a credit repair company to do this for you. Simply contacting the credit bureau may resolve inaccuracies and may result in a credit score increase.

Correcting legitimate inaccuracies can add a few points to your credit score and takes approximately 30-90 days.

6. Increase Your Credit Limits

While it may seem counterintuitive to increase your credit limit while you are trying to decrease debt and restore credit, a higher credit limit can lower your overall credit utilization ratio, making your credit score increase.

Only request an increase in credit limits if you are confident that you won’t use the additional credit to “max-out” your debt.

When requesting an increase the credit card issuer may do a “hard pull” of your credit score to determine if you are a customer in good standing. The hard pull could trigger a temporary dip in credit score. Be sure to ask your credit card issuer, “Will this request trigger a hard pull on my credit report?”

CU SoCal members can apply for a credit limit increase by

submitting an application online, calling us at 866.287.6225. or visiting your nearest CU SoCal branch.

7. Use Credit Monitoring to Check Your Progress

Credit monitoring and credit score monitoring services are available through credit unions, banks, credit card companies, credit bureaus, and independent providers.

These services provide 24/7 monitoring of your credit score and can alert you to possible fraud and identity theft.

Through its Reward Checking Account, CU SoCal offers members credit monitoring services with access to three-bureau credit monitoring, a monthly credit score, and annual credit report.

Your personal information will also be monitored on the dark web for things like password resets, fund transfers, compromised credentials, address changes, and unauthorized accounts access.

How Long Does it Take to Repair Your Credit Score?

Of course everyone wants to know the fastest way to rebuild credit, but the fact is, the time it takes to rebuild or restore credit depends on how damaged your credit was to begin with.

Incidents like bankruptcy and foreclosure stay on your credit report for 7-10 years. Generally speaking, if you follow the suggestions we’ve provided here, you can start to see improvement in your credit score in as little as 30 days, but it could take up to 18 months for your credit to fully recover.

Rebuilding credit and improving your credit score fast will take time and effort, but are well worth it. To avoid credit trouble we always recommend paying your bills on time, paying down outstanding balances, and not taking on new debt.

Why Choose CU SoCal For Your Next Credit Card

CU SoCal's credit card offerings are tailored to your specific needs, and our members can always count on us to deliver excellent customer service.

Here’s what you need to know about

CU SoCal’s credit card offerings:

CU SoCal Platinum Rewards Visa

Our Platinum Rewards Visa lets you collect dream points on every purchase you make, both online and in-store. Additionally, it has no annual charges, and you can earn 15,000 bonus points when you spend $2,500 or more within 90-days.

Plus, if you have a CU SoCal's Visa Rewards debit card, you can pool your points together!

CU SoCal Topaz Visa

The key benefit of our CU SoCal Topaz Visa credit card is the ability to transfer high interest revolving debt at 2% APR. The CU SoCal Topaz Visa card offers low 2% transfer fees and carries no annual fee!

Apply for a CU SoCal Credit Card Today!

No matter what your financial goals are, CU SoCal is here to help.

Please don’t hesitate to call us for a no-obligation consultation, or, if you’re ready, feel free to apply for one of our credit cards online today!

Get Started on Your Credit Card Today